Making sense of investment markets

Next-generation technology that enables you to skillfully navigate investment markets and their complex nuances

Next-generation technology that enables you to skillfully navigate investment markets and their complex nuances

Our investment framework enables you to perform rigorous and sophisticated analysis, making your investment decisions more nuanced and informed.

Perform advanced computations in a matter of minutes to maximize the time you spend on actual investment and risk analysis.

Experience significant cost savings related to research and development as well as testing, documentation, installation and maintenance.

An elegant integration of various investment and risk technologies form a cohesive yet very flexible framework that gives you low-level control.

By combining cutting-edge research and technologies, we offer truly novel functionality and solutions to long-standing problems.

Our solutions are always up to date, ready to use and require no local installations. You simply input your data and start to analyze.

The Investment Simulation module enables you to simulate realistic future paths for the returns and risk factors that are relevant for your investments and portfolios. Methods include novel Time- and State-Dependent Resampling as well as cutting edge generative AI, allowing you to accurately capture the many nuances of real-world markets.

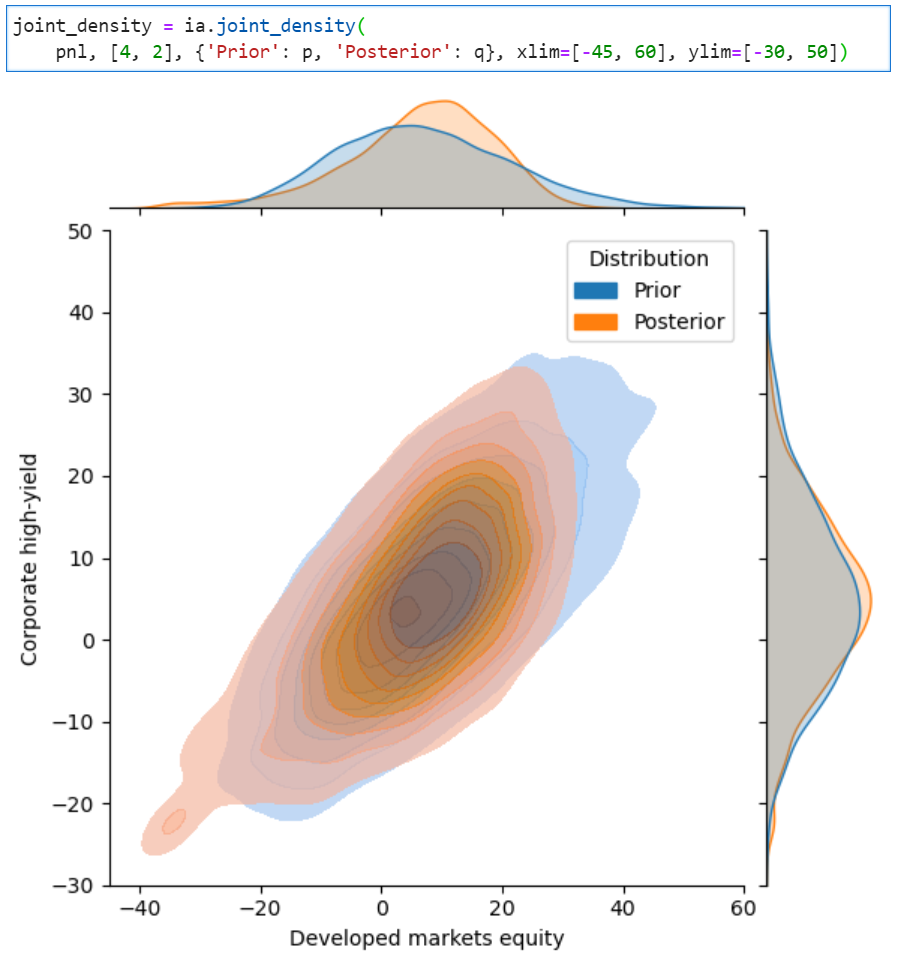

The Investment Analysis module is a highly flexible and cohesive system of subjective views, stress-testing, portfolio optimization and analysis technologies that operate on return and risk factor simulations. Methods focus on analysis of tail risk and the ability to combine discretionary inputs with data for causal and predictive market views and stress-testing.

The Data Science Server allows you to hit the ground running with data analysis in Python without spending resources on installation and maintenance. It contains optimized environments that include the most relevant data science and AI/ML libraries for investment professionals in addition to our open-source package.

The Portfolio Constructin and Risk Management book contains a thorough presentation of our investment framework and methods.

The Applied Quantitative Investment Management course gives a detailed walkthrough of the Portfolio Constructin and Risk Management book as well as its accompanying Python code.Sophisticated institutional investors solve their most complex simulation, analysis and portfolio construction problems using our solutions.

Make sense of their most complex portfolios that include derivatives, leverage and hedge fund strategies.

Get the most out of their asset allocation decisions by maximizing diversification and reducing tail risk.

Invest insurance premiums to keep up with inflation and in accordance with their liabilities.

Make sure that their portfolios follow the risk and investment objectives set out by the family.

Invest capital to maximize the probability of meeting their existing and expected commitments.

Explore open-source Python implementations of some of our fundamental technologies by visiting our open-source site.

If you want access to a stable and optimized Python environment that includes our open-source package, please subscribe to the Data Science Server.

Note that our open-source software is completely separate from our proprietary solutions and therefore not representative of neither the quality nor the functionality of the Investment Simulation and Investment Analysis modules.

If you are an institutional investor who wants to experience how our open-source methods can be used for sophisticated analysis in practice, please request a demo including a short presentation of the company you work for.

Fortitudo Technologies offers novel investment software as well as quantitative and digitalization consultancy to the investment management industry. We develop environmentally friendly solutions in close collaboration with institutional investors and run our code on some of the world’s cleanest cloud servers.

We are strongly committed to environmental sustainability and always strive to minimize our environmental footprint. Hence, we are a paperless company and therefore kindly ask for your understanding in relation to us being unable to send or share any printed material.